Many are the times I

have heard the popular myth that cats have nine lives. If that were possible,

it would have been nice for the most pure hearted humans to be granted the nine

lives instead. As the saying goes, ‘the good die young’. Unfortunately, the nine lives story is but

just a myth or even wishful thinking. If it were true, who keeps count? Cats

and nine lives aside, every year on January 13th we make it yet

another year since my father died and since last week on the 13th, my

mind has been musing over death.

If you have read the

book “the stoning of Soraya M”, you’d agree with me that it portrays

a very difficult reality. It is more difficult to comprehend, when you see the

graphic images of Soraya’s stoning in the movie of the same title.

What really catches

my attention is not really the brutality with which Soraya’s execution was carried

out. It is not the subject of the eligibility or morality of sharia law. It is

not the subject of the extent to which family should stand by one another in

times of adversity. It is not even the issue of loyalty to marriage vows or the

lack of it for a husband to go as far as framing his wife in order to have her out

of his way, to the extent of having her executed. What catches my attention is

Soraya’s reaction to the whole ordeal.

Facing the prospect

of a public execution by stoning, Soraya gives two reactions I took note of.

- She shows her selflessness by putting the feeling and

reactions of her children ahead of those of her own or any impending pain.

- She declares she is not afraid of death, but of dying.

In her second

reaction, as she is being led to the

‘stoning square’, her aunt stops and looks into her eyes and asks, “Soraya, are you afraid?”

After a pause and

some brief silence, Soraya responds and says, “I am not afraid of death, I am afraid of dying.” Soraya concludes,

“I am afraid of the pain of my death, the

pain from the stones, but I am at peace with myself and my God.”

|

| Is life this peaceful on the other side? |

Not Afraid of death

but dying:

Recently the prospect

of facing death has crossed my mind a couple of times. Musing over death when

not a preoccupation, is not melancholic but prudential. I have come to accept death

as an inevitability that eventually catches up with everyone young, old,

African, European, Asian, Caucasian etc. I choose not to live in denial of

death’s inevitability. I am not afraid of death. This helps me focus on the

present to enjoy moments I spend with others and of course plan for life after

the curtain has closed. Musing over death helps to remind me of my obligations

to prepare for life after death. Like Soraya I am not afraid of death, but

afraid to die.

In the words from

Ecclesiastes, ‘there is a time to be born and a time to die.’ Despite its

inevitability, no one truly prepares for death. Financial planning that may

include life insurance or a will can never truly replace one’s existence. How

does a wife suddenly move on after her husband passes on? How does a daughter

or a son move on after the passing of a parent? I am not afraid of death but am

afraid of dying because of those I will leave behind when I am gone.

Death is too

important to ignore, yet that is what happens all too often, at great cost to

society especially family left behind. As I muse over death I find myself not

afraid for myself but those that I may leave behind.

How I miss my father

The greatest fear I

have of dying comes when I think of the pain my family would go through. Yes

they say time eventually heals all wounds and everyone moves on, but it is also

true that some wounds leave marks that last forever. The thought of dying and

leaving my wife, son, mother, sisters and all other friends and family is not a

pleasant one. My experience tells me it is extremely a difficulty place to be.

My own father died when I was just about 8years old and even though this is not

a subject I discuss every day, I really miss him. God I really missed him all

those years and I still miss him. He went away before I even knew who he really

was and what he stood for. I remember him as a passionate soft spoken and

humble man. I have a few memories of him but because I was too young, some of

them are blurred. One incidence though stands out as my recollections of the incident

are still vivid to this day.

Nature and Wildlife

management/protection were very much a big part of my father’s work and spare

time activity. So on that particular day he was to travel for some hunting trip

to Liuwa National Park in the Western province of Zambia. As young as I was

then, my sixth sense communicated to me that he was to leave for a considerable

number of days. The truth is I wanted to go with him, but, a hunting trip is

not one where toddlers accompany their parents. But because I was determined, I

hid in his car and my presence was only discovered after he had driven a

substantial distance. At that point his main concern was to catch up with the

rest of his hunting party so he decided to drive on.

Most African parents

of my time would have spanked their child for such a prank, but my dad saw this

as bonding time between father and son. That trip would turn to be the first

time I set my eyes on the Zambezi and Luanginga rivers. We went through Libonda

pontoon and then deep into the Barotse flood plain. I was left at Siliya

Village, the place of my mother’s birth while he went ahead for his hunting escapades.

Two days later he would come to pick me up and we returned home to Mongu.

For me this was top

notch fun, even though the whole journey back home my mind was preoccupied with

thoughts of the type of welcome – or is it wrath that would befall me from my

mother. Mine was a stupid stunt.

That stunt and many

other few incidences and memories of my dad are vividly replayed in my mind

every time it’s 13th January the day my father died. If you haven’t

lost your father at an age that I was at you wouldn’t really understand how I

missed the man while growing up. There would be times in primary school when

all the boys spoke of their fathers in many different ways I felt left out of

such conversations. Admitted, every human has got their own shortcomings, but I

never saw a man who was as revered even by his subordinates as my father was.

Perhaps all the years I was growing, I may have been looking for a father to

just hold my hand and be the warden in my life that walks me through life.

Even though I had

older brothers, brothers in law and even uncles to play the part of male parent

there were many moments when I needed my father with me. Am talking of my

father, and not a father figure, I needed my dad along the way. We all have jaundiced

memories of our parents. But nothing comes close to a perfect being like a

father is in his boy’s eyes. I see this in my son’s eyes. I am his hero and it

would crush him if I wasn’t there tomorrow. He expects that I know everything

and that I am the best at everything. He seeks answers for everything from me.

Maybe when he grows much older he will see the other side of me that says,

‘just human’.

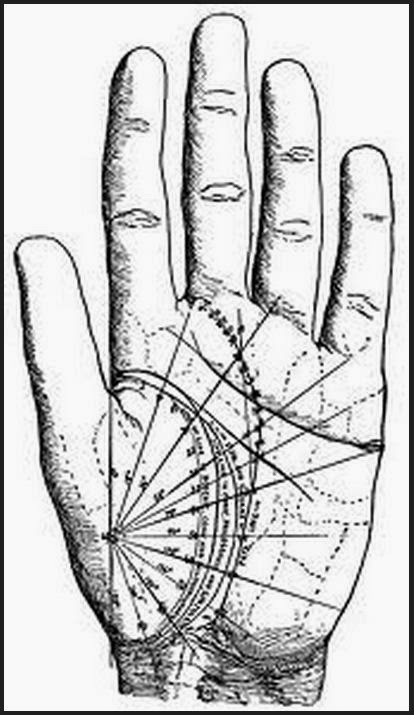

|

| Some Astrologers can read palms and claim to predict your path in life - including death! |

If I could

predict death

One

well known astrologer, Richard Houck, in his book Astrology of Death wrote

insightfully and intuitively on the topic of predicting death. However, he was

unable to accurately predict his own death. Using his own techniques he predicted

his demise to be in 2031, but he died of cancer in 2001.

The fact is whether I know exactly

when, does not matter as death will eventually come my way. Tomorrow I may not walk among you, I may not eat from the same table as

you, I may not drive on the same roads as you. Like many mortals before me, I

will have to succumb to the hand of death.

I am not

immortal, and this I will not pretend not to know.

As I live each day knowing not, when the breath of life will

depart from me, I periodically muse over my fate if every moment was the last

day of my earthly existence. Death is too important to ignore. Yet that is what

happens all too often, at great cost to society, to one dying, and to those

left behind.

It is certain that death is coming – I

do not need to know when that moment will arrive. At every moment I have

the opportunity to make choices to love my family so that when am gone they

have rich memories of our times together. I have an opportunity to make choices

to be helpful to my community. Jesus of Nazareth identified the goal of human existence as life

abundant.